Twenty twenty was truly an year of weird winds. The repercussions hasn’t yet ended. GameStop, the American retailer’s stock has been throwing tantrums at fund managing firms. So much so that the stock has surged over 1600% despite the odds.

Why do I say odds? Because the retail market worldwide has been massively hit by the global medical pandemic COVID-19. And GameStop is the major player of video games in the United States, the worst-hit country by a coronavirus. As the market started to slow down, market research firms and analysts marked GameStop as bearish, with obviously justified metrics.

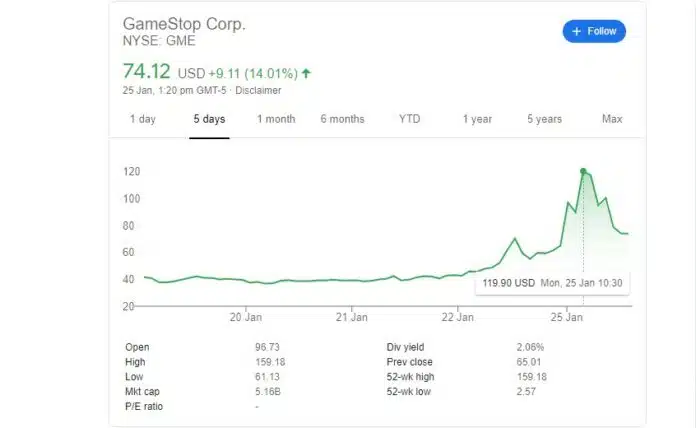

Just last year GameStop’s stock was trading well under $4.02 and today, it made new highs of $159.18.

What is fueling Game Stop’s meteoric rise?

Reddit. It’s no joke. Market analysts and researches have been down rating GameStop’s stock, thus, making it garner attention of Reddit community, which has now taken it as a challenge.

It is based on no metric, no fundamentals and absolutely no intrinsic value to justify the price. Citron Research the lead bearish firm on Game Stock clashed with Reddit’s army head-on with currencies. After the rebuttal, GameStop’s market value went over $4.5 billion briefly on Friday.

On the flip side, activist investor and Chewy Inc. co-founder Ryan Cohen was added to GameStop’s board, which is a new development and opens up a wide range of avenues for the company to restructure its operations.

Despite the expert executives, financial charts and in-depth analysis, accumulated of experience & fancy tools, Reddit had the last laugh this past week.