In a world where virtual experiences dominate entertainment, Counter-Strike 2’s skin economy is gaming’s most valuable secondary market. As of April 2025, CS2 skins had a market capitalization of approximately $4.5 billion, with values sometimes reaching over $5 billion during premier esports events. This growth is driven by a combination of community ingenuity, psychological scarcity, reputable trading frameworks, and sociocultural forces, factors that have turned basic cosmetic items in the game into sought-after digital assets.

The Emergence of a Digital Economy

The foray of Counter-Strike into cosmetics started in August 2013, when the Arms Deal update added weapon skins to CS:GO. Started as a novelty, the system soon found its way into players’ imaginations. By adding rarity tiers from Mil-Spec Encourtesy blues to legendary Contraband Howl series, Valve established an ecosystem where looks and status became intermingled. Community developers, given power through Steam Workshop submissions, added legendary skins like the Asiimov series for the M4A4, investing high-level art with grassroots credibility. These early roots established the basis of today’s $4.5 billion market cap.

When CS2 debuted on Source 2 in September of 2023, the players kept all their inventory of CS:GO skins, but the game’s new graphics and revised lighting made high-end cosmetics outshine even more. Demand for extremely rare “Blue Gem” Case Hardened designs and Doppler knife models surged. In a matter of months, the skin economy of CS2 overtook previous valuations, reaching a high of over $4.2 billion in March of 2025.

Valve’s Financial Windfall

Although most skin transactions are made through third-party marketplaces, Valve’s profits are primarily derived from case key purchases and Community Market fee income. Players opened over 400 million cases between CS:GO and CS2 alone in 2023, buying keys for $2.50 each, providing estimated gross sales of $1 billion prior to fees and regional tax adjustments. The case-opening feature, similar to loot boxes, was incredibly lucrative. March 2025 alone had Valve raking in $82 million in key sales revenue for a single month.

Aside from keys, Valve charges a 15 percent commission on all Community Market transactions. With hundreds of millions of times skins are exchanged each year, that fee system adds hundreds of millions of dollars to Valve’s yearly bottom line, highlighting the firm’s dependence upon cosmetics as a central revenue driver, even exceeding direct sales of games.

Anatomy of Scarcity and Speculation

Its very essence, CS2’s skin economy lives off psychological scarcity. Valve classifies items into tiered rarities, from common Consumer Grade to the coveted Contraband and extremely rare Exceedingly Rare knife drops. Wherein each rarity, float values dictate wear, and discrete pattern indices give some items micro-rarities. A low-wear “Blue Gem” Case Hardened skin, for example, might reach six-figure prices, whereas a common variant reaches mere dollars. These pattern-driven exceptions give rise to speculative activity similar to trading floor arbitrage, in which collectors pursue the most elusive commodities and investors scan price graphs for arbitrage.

Professional traders utilize custom analytics tools, which scrape Steam Market APIs and third-party price aggregators, to monitor price trends across regional markets. Price divergences (such as those between Western markets and Asian platforms, like Buff 163) present fertile ground for cross-market arbitrage. However, they also carry risks of regional payment prohibitions and fraud. This speculative environment is not only appealing to players but also to financial agents who consider skins as other digital assets, diversifying portfolios with cryptocurrencies and NFTs.

Community as Co-Creators

Valve’s move to crowdsource skin designs via the Steam Workshop has been a game-changer. By making submissions publicly available, Valve tapped into the collective imagination and created a feeling of ownership among gamers. Popular Workshop content chosen through community polls becomes official in-game content, with the designers earning royalties on the sale of cases. This model lets creators profit from popular designs while Valve maintains a rotating docket of new cosmetics, and players feel invested in the content pipeline. Legendary skins like the AK-47 “Fire Serpent” and Covert M4A1 “Hot Rod” are representative of this synergy, with high valuations and brand recognition outside of the game itself.

Additionally, content producers and esports personalities boost skin desirability. Influencers displaying unique knives or souvenir-level weapons during broadcasts lift skins from being mere digital trappings to cultural icons. Fans, motivated by in-game status, swarm to buy and sell skins, further developing secondary markets.

Infrastructure and Trust

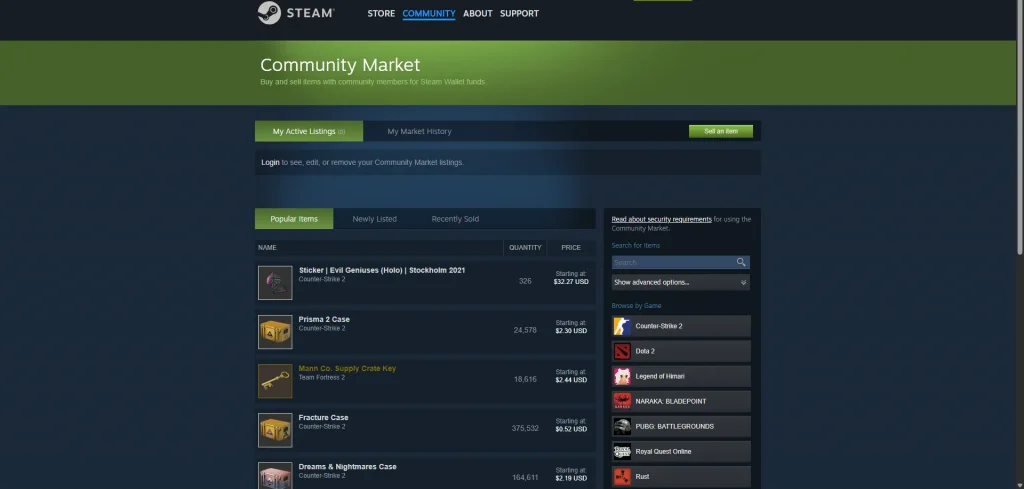

A secure trading platform is essential for valuable digital property. Valve’s Community Market, built into the Steam client, provides buyers and sellers with an open, escrow-protected marketplace. Third-party sites like CS.Money, Skinport, and CSFloat supplement Valve’s platform through the availability of fiat payments, detailed analytics, and reduced fees. Combined, these sites provide high liquidity and shield traders from fraud, key elements supporting trader trust.

However, price stability evades us. Coordinated “pump-and-dump” operations traders artificially pump the price of items prior to dumping assets, undermining confidence and creating volatility. Regulators and exchange operators keep beefing up anti-manipulation measures, but the decentralized character of trading prevents total oversight.

Market Corrections and Resilience

Skin gambling arose in tandem with trading, with third-party platforms offering roulette, crash, and sports bets with skins as currency. The unregulated economy attracted millions in bets but elicited legal fury at its similarity to underage gambling. Valve’s 2016 operation, cracking down on skin betting and following anti-gambling policies, compelled numerous sites to close or shift away from bets backed by skins. But by 2025, several operators emerged with tokenized economies, obscuring gambling/trading boundaries. Lawmakers across the globe analyze loot-box mechanisms, and looming regulations potentially could drastically redefine Valve’s case key model and third-party betting routines.

Even with its meteoric climb, CS2’s skin market has endured meaningful corrections. Late in May 2025, a pricing bug on the Asian marketplace Buff 163 caused a brief dip of nearly $1 billion in market cap, which was reversed within 24 hours after the bug was fixed. More meaningful declines follow worldwide esports off-seasons and wider market headwinds when speculative manias subside, trading volumes dwindle, and prices pull back. But each downturn has been followed by strong bouncebacks, proving durability fueled by steady player interest and collectors’ demand for scarcity.

Verdict

Counter-Strike 2’s skin economy is the epitome of the evolution of digital cosmetics into a complex, multi-billion-dollar industry. Through marrying community-designed products, psychological scarcity, secure trading platforms, and status symbols, Valve has created an ecosystem the size of, and on par with, traditional financial markets. Regulatory headwinds and market ups and downs offer obstacles to overcome, but the underlying drivers of creative ownership, rarity value, and global connectivity imply that CS2 skins will continue to be gaming’s most engaging secondary market for years to come.